A Model for change |

A Model for change |

The Proposal for the Single Tax System is based on a re-engineering approach to the tax system. While the proposal takes its name from the Single rate, the tax system proposed includes many other features that are essential to the goals outlined below and in the following pages.

The calculations that accompany the various models for implementing the Single Tax System are based on the goal of revenue neutrality as compared with the current system.

The proposal has three main goals:

2. Providing True Progressivity

| In striving to achieve these goals, we

have been mindful that the extent to which they can be

met is limited by the overriding constraint that the tax

system produce sufficient revenue to fund the operation

of the government. In designing the Single Tax System, we

have therefore imposed the requirement that the proposed

system be revenue neutral in comparison with the present

one. Determining the values of the principal parameters of the system - such as the sizes of the family based tax credits and the overall tax rate required - is a process which involves balancing the above goals subject to the revenue constraint We have prepared a number of economic scenarios for the Single Tax System using different tax rates and levels of family tax credits, all of which are progressive. Our modeling process however is not capable of capturing the enhanced revenues from some important base broadening measures introduced by the Single Tax System, such as changes to the capital cost allowance structure, which will be important in ultimately fixing the precise parameters of the Single Tax System. Likewise, the extent to which the system will encourage (taxable) economic activity is difficult to forecast with precision, though we know that in practice it will do so. As a result, the federal revenue produced by the Single Tax System will grow in a way allowing either a lower tax rate or larger personal credits than static analysis modeling (our approach) would indicate. Consequently, the distributional effects of the Single Tax System will be more favourable, for all income groups, than the initial models we have prepared for this publication. We have put a great deal of effort into estimating workable values for the Single Tax System based on the design of the Single Tax described in this chapter. However, no final parameters for tax rates and family based tax credits can be established given the above-noted limitations of our economic modeling which does not capture the full revenue enhancement likely to be obtained by the Single Tax System. Details of our economic models, including suggested parameters for tax rates and family based tax credits and their implied distributional impacts for a variety of scenarios, may be obtained by contacting Dennis Mill's office at (613) 992-7771. |

1. Simplifying the Tax System

A single rate and a broader tax base are achieved by reducing tax credits to those considered essential and justifiable.

Any additional tax credits will inevitably raise the tax rate for all Canadians.

A Single Rate

A single tax rate would replace the three graduated rates. This represents historical continuity with both domestic and international tax reform, and greatly simplifies the current tax system.

This change would also remove some important disincentives to productivity. For example, an employee's decision to work overtime would no longer be affected by the concern of having the related income taxed at a higher rate.

An identical single rate would apply to both corporations and individuals, thus reducing "leakage" from one system to the other.

A Lower Tax Rate - 20% / 22.5% / 25%

A lower tax rate and reduced distortions would result in increased economic activity and, ultimately, increased tax revenues, without increasing the tax burden on Canadians.

The Tax Rate is a function of the balance between revenue neutrality and the number and extent of tax credits and deductions in the system. The Single Tax System has been modeled at:

- 20% (which is considered the most desirable for encouraging investment, economic growth and job creation);

- 25% (which produces a slightly more progressive effect); and

- 22.5% (which is a possible compromise between the two).

A lower tax rate would help to improve the competitiveness of the tax system, especially in comparison with the U.S. This would help us to attract and retain investment and skilled workers. As noted in the 1987 White Paper on Tax Reform:

"lower marginal tax rates provide an increased incentive to earn additional income and thereby encourage investment and business activity"

A lower tax rate can also increase tax revenues. A lower rate for those at the top of the income scale does not necessarily mean that the "rich" will pay less tax. In fact experience shows time and time again that as tax rates are reduced those at the top pay more tax:

When marginal tax rates were reduced in the US in the 1980s the share of federal income taxes paid by the top 1% of taxpayers rose from 18% to 26%.

A similar effect was also experienced in the UK.

A Broader Tax Base

Elimination of Certain Income Deductions & Tax Credits:

In order to lower the rate of tax and simplify the tax system, a number of income deductions and tax credits would be eliminated or streamlined, thereby providing for the revenue needs of government which might otherwise be compromised by a stand alone rate reduction proposal. A detailed description of income deductions and tax credits which would be eliminated is set out in Appendix I.

Equal Treatment of all Income Sources:

Employment income, interest income, dividend income, capital gains income (including capital losses), and lottery winnings would all be taxed at the same rate.

Better Integration of Personal and Corporate Taxes:

Dividends paid to Canadian residents would be deductible at the corporate level and included in the income of the recipient. The same rate for individuals and corporations means that there would be much less "leakage" from one system to the other.

Use of Book Depreciation:

Book depreciation would be used for all public companies and a simplified CCA introduced for small businesses. By eliminating "deferred" corporate taxes through the introduction of book depreciation, the gap between the use of write-offs and income earned with respect to capital expenditures is eliminated. As a result, companies would have a reduced incentive to engage in loss transfer schemes and after-tax financing.

2. Providing True Progressivity

The Single Tax System delivers true progressivity, and even improves it, by enhancing certain basic tax credits targeted to the lowest income earners.

The tax credits that have been retained are those that contribute most efficiently to the policies that we believe are essential to a modern economy and to a fair society.

Enhanced Personal Tax Credits

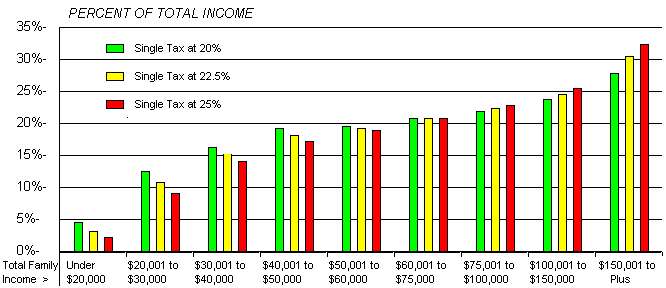

As can be seen in the following table, the use of the enhanced tax credits would, in fact, deliver true progressivity, that is: the more you earn the more you pay.

Table 4: Taxes Payable as a % of Base Income

This table shows the effective federal and provincial tax

rate* that Canadian families would pay in each income bracket

under the Single Tax.

* The effective tax rate is the percentage of total income ( before deductions ) that is actually paid in tax. SOURCE. Poschmann, Finn, using Statistics Canada's Social Policy Simulation Database and Model Release 5.1

Other Personal Tax Credits

Corporate Tax Credits

Tax Credit Options

Other credits that might be considered desirable but create some difficulties include:

3. Encouraging Economic Activity & Generating More Revenue

Encouraging Economic Activity

Improved Overall Efficiency

Fewer tax preferences mean a more neutral tax system that encourages individuals and corporations to base their economic planning on individual circumstances and sound business and financial considerations - not on tax advantages. A simpler tax system means reduced administrative costs and reduced compliance costs.

Savings

The saving to government can be used to reduce the deficit without raising taxes (and/or partially for increased auditing). The saving to individuals means more disposable income. The saving to business means increased profits or increased investment in capital or human resources (i.e. workers).

Generating More Revenue

While the Single Tax System has been designed to be revenue neutral, in practice we expect to find that significant additional tax revenues would be produced for the federal government. How would the Single Tax System achieve that result?

Reduced Tax Evasion

According to various studies of tax evaders, evasive behaviour correlates positively with high tax rates. In other words, lower tax rates reduce tax evasion. (Witness the elimination of under ground tobacco sales after the significant reduction of excise taxes on this commodity). It is therefore reasonable to assume that some revenues will be recovered from the underground economy. A simpler tax system will also increase the staff available for auditing the system. Fear of discovery has also proved to be a strong motivator to comply with the system.

Improved Competitiveness

A tax rate that is more competitive with the US and other trading partners will stem the flow of capital and high-earning labour from Canada to tax regimes that are currently more attractive. This should also result in increased GDP and, therefore, more tax revenues.

Less Dead Weight Loss:

With fewer distortions, the economy should function far more efficiently. This would reduce the loss to the current system that benefits neither the government nor the taxpayer. In this case both taxpayer and tax collector should see some gains.

Improved Productivity and Investment

When tax rates are lower, the incentive to earn and invest more increases. [See Table 5]. Governments, instead of losing approximately 53% of nothing (at the average current top marginal rate of combined federal/provincial personal income taxes) will gain approximately 30% of something. Again, in this scenario, both taxpayer and tax collector stand to gain. It is worth repeating here that countries such as the US, the UK and New Zealand, who significantly reduced their top marginal tax rates, all experienced an increase in tax revenues following this action. In both the US and the UK, the top segment of income earners paid more taxes than before. So what many saw as a tax break for the "rich" actually resulted in the highest income earners paying increased amounts of tax.

Reduced Collection and Compliance Costs

A simpler tax system results in fewer errors and omissions, reduced collection costs and lower compliance costs for tax payers. Reduced compliance costs are particularly important for small and medium-sized businesses who create most jobs in Canada. This means such companies will not only be more profitable and produce more tax revenues, but they will also be able to employ more people, thereby generating more tax revenues and relieving unemployment or welfare costs.

Table 5: How Productivity is Enhanced by the Single Tax

What you pay the tax man from every extra dollar you earn over $30,000*

| SINGLE TAX AT

20% (Federal/Provincial) You Keep 70% You Pay 30% |

CURRENT

SYSTEM (Federal/Provincial) You Keep 60% You Pay 40% |

'Under the current system of graduated tax rates, the middle marginal rate of 40% ( the average combined federal/provincial rate ) begins at just under $30,000 and applies up to just under $60,000.

4. The Effects of Change

If the Single Tax is implemented at a rate of 20% (approximately 30% combined federal and provincial rates), the effects would likely be dramatic.

These effects are produced through two routes:

Investment and Human Capital

The flow of human and capital resources away from Canada would be reversed and we would become a much favoured place in which to invest.

Economic Growth and Job Creation

Increased investment means increased economic growth, which in turn means increased employment opportunities.

Tax Revenues

From increased growth and from the incentive effects of a lower rate, tax revenues would rise. Evidence for this can be found in other countries that have introduced this type of reform.

Interest Rates

The current upward pressure on interest rates (the price of money) that results from government and industry competing for scarce investment dollars would be eased.

Deficit/Debt Reduction

All the above will greatly help the government in its fight to reduce the deficit and debt.